ROTH IRA Workshop

Start Now!

Do you Believe You are worthy of Being wealthy? Join the Roth IRA Challenge and INVEST for your future!

Start this virtual workshop to open your account, make your first contribution of only $50 and purchase stock. All video trainings, over 4 hours, available now!

Exclusive Training TAUGHT By

Dr. Lakisha L. Simmons

You want to invest more to prepare for a comfortable retirement. But you don't know where to start?

I didn't start seriously investing until I was 37 years old. Once I had a solid plan, there was no stopping and within four years, I had accumulated $750k on a professor salary as a divorcee and single mom!

Does this sound like you?

I really want to start investing. But I don't know where to start.

But was is a Roth IRA? How do I open one? How do I invest in it? Is it a savings account? I have no idea how to buy a stock?

I want to retire before 65, and don't have much to start with. You can start with $50. Watch the video where I break down how even $50 a month can add up to 6 figures over time!

When I shifted my mindset from savings to investing, everything changed for me. Now I'm traveling monthly, exercising regularly and cooking vegan foods.

You don't have to work forever, stop the rat race sooner once you learn how to save and invest more. There is a simple path to investing that doesn't involve crypto, charting or other confusing language.

In this Workshop, You'll Learn:

What is a Roth IRA account and how to invest in it. Watch it upon enrollment. (hint: you can withdraw contributions anytime without penalty). ($147)

Step by Step Tutorial: How to open a Roth IRA at Fidelity and Vanguard. Watch it upon enrollment. ($147)

Create your 2024 Roth IRA investment plan to max it out and plan for (early) retirement. Tracker available upon enrollment. ($17)

Over 4 hours of hands-on training with Dr. Lakisha L. Simmons to purchase stocks in your Roth IRA and set you auto investing schedule. ($247)

BONUS: What to do with $50 to grow it to $125k -2 part video series. Watch it upon enrollment.

EVERYTHING ABOVE plus 12 month immediate access to membership area:

- Workshop video replay and above mentioned videos

-Dr. Kisha's Proprietary Budget Bestie Financial Freedom electronic Spreadsheet

-Contribution trackers to see your contributions vs growth

-Invitation to our end of year zoom call celebration and follow up results.

-10% discount off other digital achieveher products and courses (coupon inside member area)

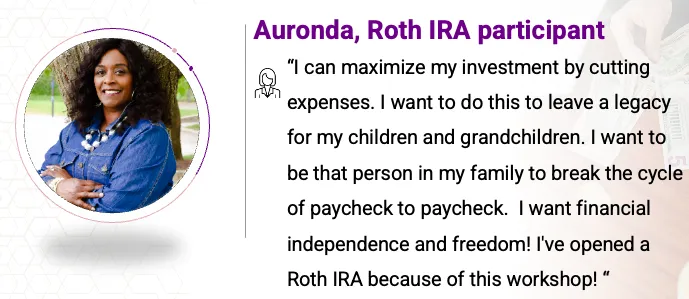

2024 Testimonials

"Dr. Lakisha is a great teacher now I must do the work." - Tawanda

"This session met my expectations, was informational, and was a relief to not be a scam!" - Roberta

Valued At $559, Now Just $59

"YES! I BELIEVE I deserve to be wealthy and I'm ready to invest for my future!"

Only $59 for all materials, recorded tutorials and videos for a limited time!

Can I have more than one Roth IRA Account?

There is no limit on the number of IRA accounts you can have. You can even own multiples of the same kind of IRA, meaning you can have multiple Roth IRAs, SEP IRAs and traditional IRAs, typically at different banks. That said, increasing your number of IRA accounts doesn't necessarily increase the amount you can contribute annually. You can only contribute up to $7,000 or $8,000 if you are 50+ in a Roth IRA.

Am I eligible to invest in a Roth IRA?

Please ensure your income is under $161,000 if single and less than $240,000 if married. If it is more you can have a reduced amount you can contribute until you completely phase out. You must have working wages, tips or business income before investing in a Roth IRA. Use this calculator from TIAA to estimate your contribution amount. https://www.tiaa.org/public/tools-calculators/ira-contribution-eligibility

Disclaimer: Investments sometimes go down and lose money just as they sometimes go up and make money. There is risk and it’s important to do your own research. Dr. Kisha is not a financial advisor, does not invest money for you and does not advise any particular stocks. She has a doctorate of philosophy degree in business and is a self-made millionaire sharing her story about her investing experience in the stock market. She has been fact checked by Business Insider where all of her investments were verified. Make your own decisions based on your own research and professional advice.